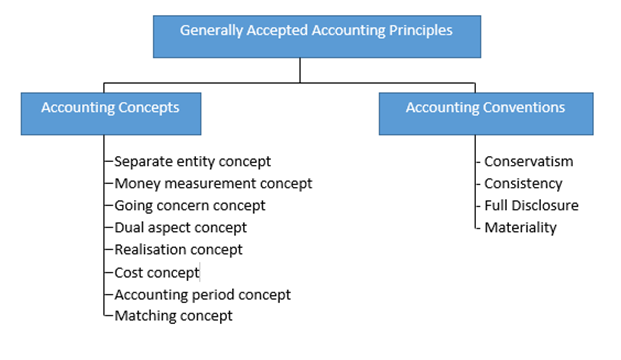

The following are the most common limitations that may arise when using GAAP: GAAP is not global While the generally accepted accounting principles strive to reduce inaccurate financial reporting and guide companies in preparing accurate and clear financial data, these principles come with limitations that should be taken into consideration when using them. Related: 16 Accounting Jobs That Pay Well Limitations of using GAAP Principle of utmost good faith: This principle entails that all parties involved in the preparation of financial records are to act in good faith. Principle of materiality: This principle states that organizations are to clearly and honestly report their financial situation. Principle of periodicity: The principle of periodicity implies that companies will perform and base their financial reports on standard accounting time periods such as fiscal quarters and years. Principle of continuity: This principle denotes that financial reports will be prepared under the assumption that an organization's operations will continue and the company will continue to be a going interest. Principle of prudence: The prudence principle entails that financial reports will be based on fact-based findings rather than speculation. Principle of non-compensation: The principle of non-compensation states that companies will report both positive and negative financial performance with no prospect of debt compensation. Principle of permanence of methods: This principle refers to a company's commitment to preparing all financial reports using the same methods and procedures. Principle of sincerity: The principle of sincerity states that accountants and other individuals using GAAP are committed to impartial and honest preparation of financial records. Principle of consistency: This principle entails that a business will use consistent standards throughout its financial reporting and if standards are updated or changed, this is clearly explained. Principle of regularity: This principle states that companies and organizations using GAAP must adhere to its regulations. The following are the key concepts, or principles, that are outlined by GAAP and that companies are expected to follow when submitting public financial statements: Related: Your Guide To Careers in Finance Principles of GAAP Specific industries may have more strict rules to follow under GAAP and each industry may vary significantly. The following are the topics that GAAP incorporates into a company's financial statements: These principles are also used by taxpayers and citizens to ensure that the government is held accountable. GAAP allows the easy analysis and comparison of one company's financial statements to other organizations and is an important component when a company is being evaluated by investors, potential donors and lenders. Organizations may use GAAP to organize their financial information into accounting records, create public financial statements and outline supporting information that may be important to these statements. businesses use GAAP, it is required by law for publicly traded companies and businesses that release their reports to the public to use the GAAP guidelines when submitting financial reports.

These principles are used by the Financial Accounting Standards Board to outline its approved methods of accounting and how and what should be included in an organization's financial reports. GAAP, which stands for generally accepted accounting principles, is a set of agreed-upon rules that most public businesses and corporations follow when reporting their finances. In this article, we will explore what GAAP is, the principles of GAAP and tips for incorporating these principles into your business. Understanding and utilizing GAAP can help your company's financial status be better understood by investors and lenders and ensure that you are practicing the most acceptable and accurate accounting principles possible.

GAAP, or the generally accepted accounting principles, is an important part of the accounting world and is the standard by which businesses are required to report their financial statements in the United States.

0 kommentar(er)

0 kommentar(er)